India aims to become the next “factory of the world” with a broad spectrum of measures, schemes, and initiatives. Make in India, PLI (Production Linked Incentive), DLI (Design Linked Incentive), ease of doing business reforms, skill development programs, and infrastructure projects are crucial to achieve the same and attain the coveted status of ‘Viksit Bharat 2047’ and foster inclusive economic growth and participation of diverse industries and empowered citizens.

Becoming the factory of the world is not possible without embracing a smart manufacturing system. Technologies of Industry 4.0 including AI, ML, Robotics, IIoT and others have become a core part of modern factories and are the crucial skills-to-be-learn for the future of smart manufacturing.

PLI (Production Linked Initiative) is India’s flagship initiative to encourage ‘Make in India’, bring advanced technologies to the Indian manufacturing sector and explore smart manufacturing scope at its fullest. In this passage, we will explore the impact and expectations of PLI. Most importantly, the success of PLI in creating a smart manufacturing ecosystem depends upon a collaborative roadmap of government, educational institutions, and industry for industry 4.0 training, active workforce participation, and successful implementation.

Production Linked Initiative (PLI): Launch, Provisions and Impact

The Production Linked Incentive (PLI) was launched in March 2020 to enhance domestic manufacturing capability, accompanied by employment generation for the future of smart manufacturing and greater import substitution.

PLI scheme initially targeted three industries:

- Mobile and Allied Component Manufacturing

- Medical Devices

- Electrical Component Manufacturing

Later the scheme was extended to 14 sectors.

Core Idea: The government of India offers financial rewards to domestic and foreign organisations for manufacturing in India under the PLI scheme, based on a percentage of their revenue over up to five years.

The 14 Sectors in Focus for the PLI Scheme;

- Mobile Manufacturing

- Medical Devices Manufacturing

- Automobiles and Auto Components

- Pharmaceuticals

- Drugs

- Speciality Steel

- Telecom and Networking Products

- Economic Products

- White Goods (ACs and LEDs)

- Food Products

- Textile Products

- Solar PV Modules

- Advanced Chemistry Cell Battery

- Drone and Drone Components

How does the Government disburse incentives under the PLI Scheme?

Incentives are measured based on incremental sales. For some focus industries including Textile products, drone components, and advanced chemistry cell batteries, incentives are calculated based on turnover, local value addition over five years, and performance.

The focus on research and development while considering a manufacturer for incentives helps the domestic industry to keep up with the global trends and the future of smart manufacturing in Industry 4.0 and beyond. It makes Indian manufacturers competitive in the evolving global market.

Impact of PLI Scheme for Smartphone Manufacturing and Other Sectors

- Production Linked Incentive (PLI) aims to develop a smart manufacturing ecosystem to explore the untapped potential of India’s manufacturing sector, attract foreign investments, and generate economies of scale.

- Since its commencement in 2021, the Indian manufacturing sector has received investments worth more than Rs. 1.03 lakh crore to leverage the benefits of the PLI scheme. The investments have created more than 6.78 lakh jobs and led to sales and production worth Rs. 8.61 lakh crore during the same period.

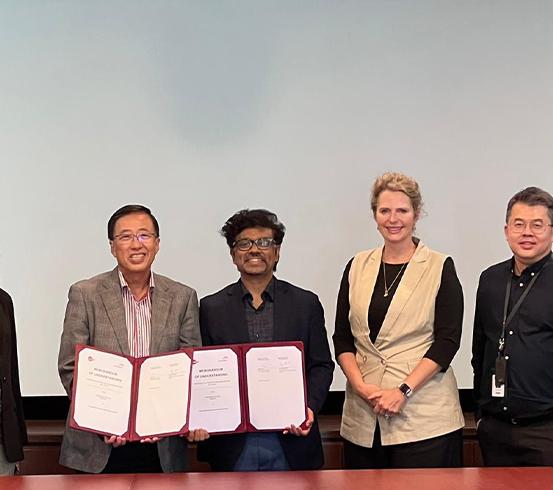

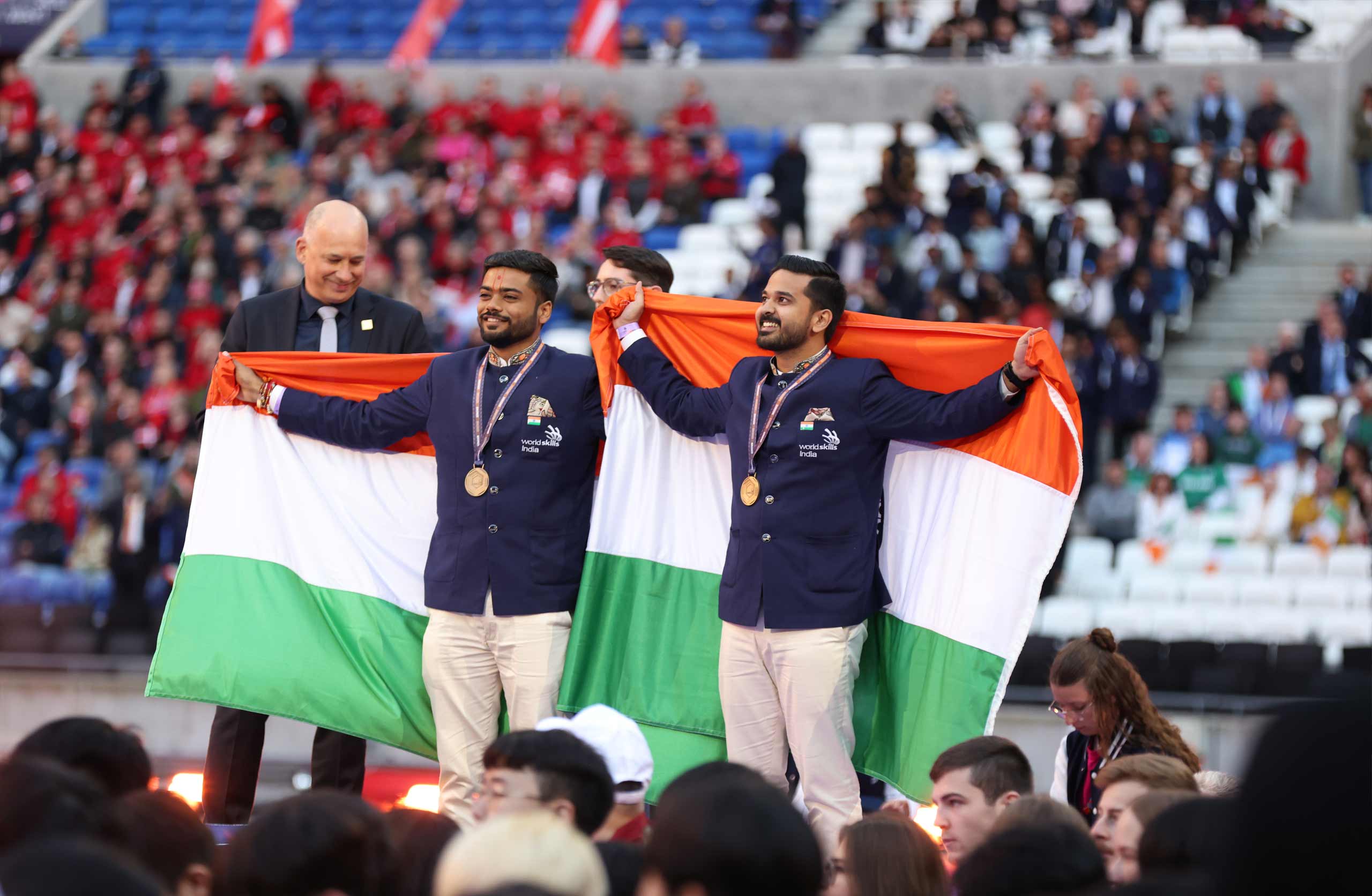

- Skill enhancement is a crucial element to leverage the incoming foreign investments in green-field and brown-field manufacturing projects. It requires active participation of industry, academia and the government. NAMTECH, a new-age institute, is working significantly to groom techno-managers with future demand courses in India.

- Smartphone exports have zoomed over 139% with investments of more than Rs. 4,784 crores. According to Canalys, a market analyst firm, smartphone units shipped in India during Q2 2024 were 36.4 million units with Vivo and Xiaomi controlling the lion’s share of the market.

- The automobile sector has attracted proposals for investments worth Rs. 74,850 crore over five years. The food processing industry has benefited handsomely with an increased focus on local sourcing of raw materials.

- Rise in FDI inflow during FY 2022-2023 including 46% in pharmaceuticals and drugs, 26% in the food processing industry, 91% in medical appliances and more.

PLI has accelerated India’s run towards a ready production ecosystem for the future of smart manufacturing. And institutes like NAMTECH are providing industry-aligned smart manufacturing programs including iPMP in Smart Manufacturing and iPTP-A to groom professionals to design, implement and run future factories.

Production Linked Incentive (PLI): Future Course

- The First edition of PLI was approved by the Union Cabinet on 21st March 2020. Union Finance Minister Nirmala Sitharaman emphasised its significance for India’s readiness for Industry 4.0.

- She announced in May 2023, “Allocation for PLI has hiked from the initial Rs. 1.97 lakh crore to Rs. 2.06 lakh crore. Also, it included the Rs. 9,765 crore budget outlay for IT Hardware under the PLI 2.0 scheme.” The extended PLI scheme will include three new manufacturing sectors (toys, leather and e-bikes) along with the existing 14 sectors.

- The Government of India reopened the application window for the PLI scheme for white goods from July 15th to October 12th 2024 to feed the industry’s appetite to invest more to leverage the scheme and thrive in Industry 4.0.

- The PLI White Goods scheme will serve the growing market and confidence generated by the production of key elements of LED lights and ACs in Industry 4.0. As of July 2024, 66 applicants have been shortlisted under the PLIWG with a commitment to invest Rs. 6,962 crore in coming years.

Expectations from Budget 2024 for PLI and the Future of Smart Manufacturing in India

- Industry leaders want the government to expand and implement PLI to benefit organisations across the value chain from small component makers to big OEMs.

- ICEA stated, “The government should draft appropriate policies and financial cushion to support the manufacturing sub-assembly ecosystem and large-scale components, with a longer incentive period and gestation.

- Reduction in tax and tariffs including lower inputs tariffs for electronics manufacturing

- Industry 4.0 training for developing a strong pool of techno-managers to design and operate the future of smart manufacturing. It will require the active participation of industry, academia and the government.

Explore futuristic smart manufacturing programs at NAMTECH and apply now.

Reference Links

https://www.thehindu.com/business/Economy/govt-reopens-pli-scheme-for-white-goods-till-october-12/article68382477.ece

https://economictimes.indiatimes.com/industry/cons-products/durables/white-goods-pli-reopens-more-time-for-companies-to-crack-open-ac-led-production/articleshow/111586910.cms?from=mdr

https://www.gadgets360.com/mobiles/news/indian-smartphone-market-shipment-growth-canalys-report-6131826

https://inc42.com/features/union-budget-2024-nows-the-time-to-broaden-pli-focus-urges-indias-electronics-manufacturing-industry/#:~:text=It%20also%20announced%20a%2030,green%20hydrogen%20and%20solar%20power.